Enhancing Financial Management by Navigating the UK Debt Landscape

Debt remains a significant challenge affecting millions of individuals across the UK, greatly influencing their financial choices and emotional well-being. It is essential to cultivate a thorough understanding of the debt landscape, which encompasses various types of debt, their broad-ranging effects, and the most recent statistics. By comprehending these aspects, individuals grappling with financial difficulties can make informed decisions and pursue tailored solutions that cater to their specific needs. Recognising the intricacies of debt management empowers people to take proactive steps towards achieving financial stability and enhancing their overall quality of life.

Exploring the Diverse Forms of Debt Encountered in the UK

In the UK, individuals face a myriad of debt types, each characterised by distinct features and implications. The most prevalent form of debt is <a href=”https://www.debtconsolidationloans.co.uk/credit-card-debt-solutions-for-a-fresh-financial-start/”>credit card debt</a>, which often arises due to exorbitant interest rates and a lack of repayment discipline. Many individuals rely on credit cards for everyday purchases, leading to escalating balances that can rapidly spiral out of control. Moreover, personal loans significantly contribute to consumer debt, often taken out for major purchases such as vehicles or home renovations. Mortgages are frequently perceived as essential financial commitments, yet they can become burdensome, particularly during employment changes or unexpected financial strains. Understanding these various forms of debt is crucial, as each type carries its own responsibilities, interest rates, and repayment structures that can profoundly affect personal financial health.

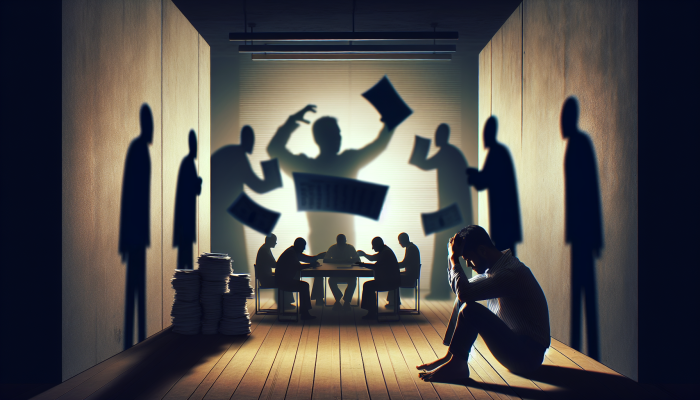

Assessing the Deep-Seated Effects of Debt on Individuals

The ramifications of debt on an individual’s mental health and financial stability are profound and frequently underestimated. Those encumbered by financial obligations often experience elevated levels of anxiety, stress, and a pervasive sense of hopelessness. This emotional burden can lead to various physical health complications, strained relationships, and a significant decline in overall quality of life. As debt accumulates, financial stability becomes increasingly precarious, often resulting in a detrimental cycle of borrowing to meet existing obligations. The consequences extend beyond the individual, impacting families and entire communities that bear the weight of financial distress. Recognising the psychological impact of debt is vital for individuals seeking assistance and effective strategies to overcome their financial hurdles.

Investigating the Latest Debt Statistics and Trends Across the UK

Recent statistics paint a concerning picture of debt levels throughout the UK. Various reports indicate that millions of households are grappling with debt, with average personal debt levels rising significantly year after year. The Bank of England consistently releases data reflecting trends in consumer credit, revealing that while certain borrowing categories are on the decline, others—most notably credit card debt—persist at alarming highs. These statistics underline the urgent necessity for a proactive approach to debt management and the exploration of strategies such as debt consolidation to relieve ongoing financial pressures. By effectively tackling debt, individuals can begin to reclaim control over their financial future and strive towards a more secure economic landscape.

Reflecting on My Personal Debt Journey Prior to Consolidation

As I contemplate my financial journey, I can clearly ascertain the heavy load of multiple debts accrued from various sources. Understanding my situation not only clarified my personal experiences but also highlighted the common challenges many individuals encounter in similar situations, underscoring the importance of comprehending one’s financial landscape to enable more informed decision-making.

Examining the Debt Accumulation Journey and Its Associated Challenges

The path to accumulating debt often begins innocently, yet in my case, it quickly escalated into a serious concern. Initially, I utilised credit cards for convenience, blissfully unaware of the long-term consequences tied to high-interest rates. As my circumstances evolved, I sought out personal loans with the aim of improving my financial situation; unfortunately, these loans only exacerbated my financial stress. The ease of accessing credit in the UK can be misleading, as lenders frequently fail to adequately explain the potential pitfalls. Before I realised it, I was juggling payments from multiple loans and credit cards, each carrying different interest rates and due dates. This accumulation of debt shifted from a situation that seemed manageable into an overwhelming burden—a narrative that resonates with many individuals across the UK.

Overcoming the Difficulties of Managing Multiple Debt Payments

Managing numerous debts often felt akin to maintaining a full-time job. Each month, I was faced with the daunting task of remembering various payment due dates and navigating differing interest rates, leading to confusion and mounting stress. The constant dread of missed payments overshadowed my every thought, with late fees compounding my financial troubles. The absence of a clear overview made it challenging to devise an effective repayment strategy. Many individuals in the UK find themselves in comparable predicaments, overwhelmed by the intricacies of personal finance. The true challenge lies in discovering solutions that streamline this chaotic landscape, often leading to the consideration of debt consolidation options that can restore financial clarity and peace of mind.

Managing Stress and Anxiety Induced by Debt

The emotional toll of being in debt can be profoundly distressing. For me, anxiety became a constant companion as I often found myself losing sleep over impending payments and fretting about my financial future. The societal stigma surrounding debt intensified my feelings of isolation and despair. Many individuals in the UK endure similar emotional burdens, which can lead to deteriorating mental health conditions. The stress associated with financial uncertainty can permeate every aspect of life, adversely affecting work performance and personal relationships. Acknowledging these feelings is a crucial first step toward seeking support, as well as recognising that one is not alone in navigating this complex struggle.

Discovering the Transformative Benefits of Debt Consolidation

In the midst of my financial difficulties, debt consolidation emerged as a beacon of hope, presenting itself as a feasible lifeline. Understanding the multitude of benefits associated with this strategy and identifying the appropriate plan became pivotal in my journey toward financial recovery and renewed stability.

Comprehending Debt Consolidation and Its Multifaceted Benefits

Debt consolidation involves the process of merging several debts into a single loan, ideally characterised by a lower interest rate and more manageable repayment terms. This strategy significantly simplifies one’s financial landscape, allowing individuals to focus on a singular payment rather than juggling multiple obligations. In the UK, various options for debt consolidation are available, including personal loans, balance transfer credit cards, and secured loans. Understanding these alternatives is crucial for selecting a viable path forward. The primary advantage of debt consolidation lies in the alleviation of stress associated with managing multiple debts. This approach not only streamlines financial obligations but can also result in lower monthly payments, making it an appealing solution for numerous individuals overwhelmed by their financial commitments.

Selecting the Most Suitable Debt Consolidation Plan for Your Circumstances

Conducting thorough research and selecting the most appropriate debt consolidation plan is absolutely essential. I began by evaluating the total amount I owed across various creditors, which provided clarity on my financial situation. Comparison websites became invaluable resources, offering insights into different loan options, terms, and interest rates. Numerous financial institutions in the UK provide tailored advice for debt consolidation, so I prioritised seeking guidance from reputable lenders. A critical aspect of this process is understanding the fees associated with consolidation loans. It’s vital to read the fine print carefully to ensure that the benefits of consolidation outweigh any potential costs. With diligent research and careful planning, I ultimately identified a plan that aligned with my needs, marking a significant turning point in my financial journey.

Effectively Communicating with Lenders for Better Terms

Negotiating with lenders can appear intimidating; however, it represents a crucial step in the consolidation process. I approached my lenders with transparency regarding my situation, expressing my desire to consolidate my debts for improved management. Many lenders in the UK recognise the importance of assisting customers in navigating their finances and may offer flexible terms. Effective negotiation strategies encompass presenting a cogent repayment plan, demonstrating a sense of financial responsibility, and being open to discussing alternative solutions. Clear communication can lead to enhanced loan terms and reduced interest rates, which can significantly transform one’s overall financial landscape.

Strategically Managing Your Consolidated Debt for Long-term Success

Once I successfully secured a consolidation loan, managing this new debt became my foremost priority. Developing a budget that accommodated my new single payment was essential. I discovered that setting up automatic payments helped ensure that I never missed a due date, thereby avoiding late fees. Regularly reviewing my budget and diligently tracking my expenses became crucial practices. I learned to distinguish between needs and wants, carefully evaluating every expenditure to ensure I remained within my financial limits. Many individuals in the UK encounter similar challenges while managing consolidated debt, and adopting disciplined financial habits is pivotal for achieving long-term success. This phase marked the beginning of a new mindset towards money management, emphasising sustainability and enhancing financial well-being.

Mastering the Debt Consolidation Process: A Step-by-Step Guide

Grasping the intricacies of the debt consolidation process is vital for anyone contemplating this option. Each step, from the application stage to evaluating long-term financial strategies, plays a significant role in attaining sustainable financial stability.

Navigating the Application Submission and Approval Process with Ease

Applying for a debt consolidation loan in the UK entails several critical steps. Initially, I gathered all necessary financial documents, including income statements, outstanding debts, and credit reports. This comprehensive information created a clear picture of my financial health, enabling lenders to evaluate my application accurately. Many lenders conduct a credit check to determine eligibility, which can significantly influence the interest rate offered. It’s important to acknowledge that while bad credit may limit options, there are still lenders willing to assist individuals facing challenging financial situations. The approval process may take some time, so patience is essential while awaiting a decision.

Executing the Debt Consolidation Process Smoothly and Effectively

Once approved, the consolidation process itself is generally straightforward. The lender typically pays off my existing debts directly, allowing me to focus solely on repaying the new loan. This step significantly reduced the number of creditors I had to manage, providing me with much-needed peace of mind. It is essential to monitor the consolidation closely to ensure that all previous debts are settled. This involves keeping track of communications with lenders and confirming that no outstanding balances remain. For many individuals in the UK, this step can feel liberating, paving the way for a fresh start centred around a single, manageable payment.

Adjusting to New Payment Structures for Financial Clarity

Transitioning to a new payment schedule necessitates careful planning and organisation. I found it beneficial to create a calendar outlining all payment due dates, ensuring I remained organised and timely. Understanding the repayment terms of the consolidation loan was crucial, as it allowed me to anticipate any changes in monthly payments. Many individuals may struggle with this adjustment, but cultivating a consistent routine and adhering to a budget can significantly ease the transition. This period is critical for developing strong financial habits and ensuring that the momentum gained from consolidation continues toward achieving long-term stability.

Evaluating Different Loan Offers to Secure the Best Deal

Comparing various debt consolidation loan offers is vital for securing the most advantageous deal possible. I conducted extensive research on different lenders, considering their interest rates, associated fees, repayment terms, and customer reviews. Numerous online platforms provide comparison tools that simplify this process, enabling borrowers to make well-informed decisions. It’s crucial to assess not only the financial aspects but also the lender’s reputation and level of customer service. A well-structured loan can significantly impact the overall repayment journey, making this evaluation a fundamental step in the consolidation process.

Formulating Effective Long-term Financial Strategies for Sustainability

After successfully consolidating my debts, I recognised the importance of engaging in long-term financial planning. Establishing a budget that prioritised savings alongside debt repayments became essential. I initiated the creation of an emergency fund, understanding that unexpected expenses could derail my progress. Setting specific financial goals, both short-term and long-term, provided direction and motivation for my financial journey. Many individuals in the UK underestimate this critical aspect of financial health; however, adopting a proactive approach to financial planning can safeguard against future debt traps and instil a sense of security and control over one’s financial destiny.

Immediate Changes Noticed Following Debt Consolidation

The moment I consolidated my debts, I experienced several immediate changes that profoundly transformed my life. This new chapter was characterised by a significant reduction in stress levels and a more streamlined approach to financial management.

Discovering Lower Stress Levels After Debt Consolidation

The relief associated with consolidating my debts was palpable and life-changing. The burden of managing multiple payments was lifted, allowing me to refocus on my mental health and overall well-being. I observed a noticeable decrease in anxiety levels, as I could now redirect my energy toward more fulfilling and positive pursuits. Many individuals in the UK undergo similar transformations following consolidation, reclaiming their lives from the relentless pressures of debt. This newfound clarity enables individuals to engage more fully in their personal and professional lives, fostering a profound sense of empowerment and control over their financial futures.

Simplifying Financial Management for Enhanced Clarity and Focus

Managing my finances became substantially easier after the consolidation process. The simplicity of having a single payment streamlined my budgeting efforts significantly. I could allocate funds more effectively, knowing precisely when and how much I needed to pay each month. This clarity simplified my financial planning, allowing me to concentrate on other important aspects of my life without the constant distraction of accumulating debts. Many people in the UK find that simplifying their financial landscape leads to improved decision-making and overall enhanced financial health, reinforcing the benefits of debt consolidation.

Realising the Positive Impact on My Credit Score

One of the most gratifying outcomes of consolidating my debts was witnessing the positive effect on my credit score. With fewer accounts to manage and a consistent payment history, my creditworthiness improved noticeably. This shift opened doors to better financial opportunities, including lower interest rates on future loans. Many individuals underestimate the long-term benefits of debt consolidation on their credit ratings. By demonstrating responsible financial behaviour, it is possible to regain control over one’s financial future, paving the way for greater stability and opportunities for growth.

Long-term Financial Benefits of Debt Consolidation

The long-term advantages of debt consolidation extend well beyond immediate relief and comfort. As I navigated my new financial reality, I uncovered numerous benefits that contributed to a more secure and stable future.

Experiencing Significant Savings on Interest Payments

One of the most considerable advantages of consolidating my debts was the substantial savings on interest payments. The lower interest rate associated with my consolidation loan translated into significant savings over time. I could redirect these saved funds towards other financial objectives, such as building an emergency fund or investing for the future. Many individuals in the UK fail to recognise the long-term financial implications of high-interest debt, making consolidation a powerful strategy for regaining control over one’s financial situation. By reducing the cost of borrowing, individuals can embark on a sustainable financial trajectory that promotes stability and growth.

Enhancing Budgeting Skills for Improved Financial Health

Consolidating my debts also led to marked enhancements in my budgeting practices. With a clear understanding of my monthly payment commitments, I could create a more effective budget that accounted for all essential expenses. This discipline enabled me to avoid overspending and prioritise savings, leading to a healthier financial outlook. Many individuals in the UK find that a well-structured budget is critical for maintaining financial health after consolidation. Embracing this proactive approach fosters a sense of accountability and ensures that individuals remain committed to achieving their financial goals and aspirations.

Aspiring Toward Financial Freedom and Independence Through Consolidation

The journey toward financial independence began earnestly after consolidating my debts. With the burden of multiple payments alleviated, I could focus on building wealth rather than merely surviving from paycheck to paycheck. Establishing long-term financial goals, whether saving for a home, retirement, or travel, became a tangible reality. Many people in the UK aspire to attain financial freedom, and debt consolidation serves as a crucial stepping stone on this path. By reclaiming control over one’s finances, individuals can work towards a future defined by opportunity and stability, ultimately enhancing their quality of life.

Facing Challenges and Extracting Valuable Lessons Learned

While the journey towards debt consolidation proved transformative, it was not without its challenges. Learning from these experiences has been invaluable in maintaining my newfound financial stability and resilience.

Overcoming Financial Setbacks and Challenges

Unexpected financial challenges arose even after consolidating my debts. Life circumstances can change rapidly, and I faced situations that tested my financial resilience, such as sudden job loss or unforeseen expenses. Navigating these setbacks required adaptability and a steadfast commitment to adhering to my budget. Many individuals in the UK encounter similar hurdles, and recognising that financial recovery is not a linear path is essential. Developing effective coping strategies and maintaining a positive mindset can significantly enhance one’s ability to navigate these challenges and emerge stronger on the other side.

The Crucial Role of Financial Discipline in Recovery

Discipline became a cornerstone of my financial recovery after consolidation. Sticking to my budget and consistently making timely payments was crucial in maintaining my progress and momentum. The temptation to revert to previous spending habits can be formidable, especially during stressful times. Many people in the UK grapple with this aspect, but cultivating a disciplined approach to finances is vital for long-term success. This discipline not only helps individuals remain debt-free but also nurtures a sense of accomplishment and empowerment over one’s financial destiny.

Empowering Insights for Others Contemplating Debt Consolidation

For anyone contemplating debt consolidation, my key advice is to approach the process with diligence and a clear understanding of your financial situation. Conduct thorough research on your options and do not hesitate to seek professional guidance if necessary. Remaining committed to your budget and financial goals is paramount. Many individuals in the UK benefit from joining support groups or online communities focused on financial literacy. Sharing experiences and learning from others can provide valuable insights and encouragement throughout the journey, fostering a sense of community and collective growth.

Embracing Life Post-Debt Consolidation

The aftermath of debt consolidation has ushered in a new chapter in my life, characterised by personal growth and a renewed sense of purpose. This transformation has been profound, fundamentally influencing my vision for the future and my approach to financial management.

Experiencing Personal Growth Through Financial Recovery

Overcoming the challenges associated with debt has facilitated significant personal development. I discovered newfound confidence in managing my finances and making informed decisions that align with my values. This growth extends beyond financial management, positively impacting various aspects of my life. Many individuals in the UK experience similar transformations, recognising that financial stability often enhances self-worth and autonomy. Embracing this personal growth allows individuals to pursue their passions and aspirations with renewed energy and determination, contributing to a fulfilling life.

Prioritising Future Financial Planning for Lasting Security

Planning for the future has become a paramount focus following the consolidation of my debts. I initiated the process of setting specific financial goals, such as saving for a home and preparing for retirement. This proactive approach has enabled me to engage in comprehensive long-term financial planning, ensuring that I am well-prepared for unforeseen circumstances. Many individuals in the UK overlook the significance of future financial planning; however, it is essential for constructing a secure and stable financial future. By establishing achievable goals and regularly assessing progress, individuals can foster a sense of control over their financial destinies.

Giving Back to the Community Through Financial Education Initiatives

One of the most rewarding outcomes of overcoming debt has been my desire to assist others facing similar challenges. I have actively participated in local community initiatives focused on financial education, sharing my journey and supporting those in need. Numerous organisations in the UK aim to empower individuals through comprehensive financial literacy programmes. By giving back, I not only contribute positively to my community but also reinforce my commitment to maintaining financial discipline and responsibility, creating a ripple effect of awareness and empowerment.

Maintaining Financial Discipline for Continued Success

Sustaining financial discipline remains a top priority in my life post-consolidation. I continue to utilise budgeting tools and meticulously track my spending habits. Regularly reviewing my financial goals ensures that I stay on the right path and avoid slipping into old habits. Many individuals in the UK benefit from establishing accountability systems—whether through financial advisors, support groups, or personal finance apps. Developing and maintaining discipline is crucial for preventing future debt and fostering a healthy financial mindset, paving the way for long-term success.

Frequently Asked Questions Regarding Debt Consolidation

What exactly is debt consolidation and how does it function?

Debt consolidation is the process of merging multiple debts into a single loan, typically characterised by a lower interest rate, aimed at simplifying payments and alleviating financial stress.

How can debt consolidation truly transform my life?

By streamlining your finances, lowering monthly payments, and potentially enhancing your credit score, debt consolidation can create a clearer path to financial freedom and reduced stress levels.

What types of debts are eligible for consolidation?

You can consolidate various types of debts, such as credit card balances, personal loans, and occasionally even overdue utility bills or medical expenses.

Is debt consolidation the right choice for everyone?

Debt consolidation may not be the ideal solution for everyone; it largely depends on individual financial circumstances. Evaluating your debts, credit score, and repayment capability is essential before making a decision.

How do I select the most suitable debt consolidation plan?

When choosing a debt consolidation plan, compare interest rates, associated fees, repayment terms, and lender reputations. Ensure that the plan aligns well with your financial objectives and needs.

Will debt consolidation adversely affect my credit score?

Debt consolidation can initially impact your credit score due to the credit inquiry; however, it can lead to improvements in the long run by reducing your debt-to-income ratio and enhancing payment history.

What are the potential risks associated with debt consolidation?

Potential risks include the possibility of accruing additional debt if spending habits do not change, and some consolidation plans may contain hidden fees or elevated interest rates. Always conduct thorough research before proceeding.

How can I maintain financial discipline after consolidation?

Establish a stringent budget, diligently track your expenditures, set clear financial goals, and consider leveraging accountability tools like financial apps or support groups to reinforce positive habits.

Can I consolidate debt independently?

Yes, individuals can consolidate debt independently by securing a personal loan or a balance transfer credit card. However, seeking professional advice can provide additional insights and guidance.

What should I do if I encounter setbacks after consolidation?

Stay proactive by revisiting your budget, seeking support from financial advisors or community resources, and reassessing your financial goals. Adaptability and resilience are crucial when navigating unexpected financial challenges.

Connect with us on Facebook for further insights!

This Article Was First Found On: https://www.debtconsolidationloans.co.uk

The Article Debt Consolidation: Transforming My Life in the UK Was Found On https://limitsofstrategy.com